The new release of akquinet's "Electronic Payments" add-on module has recently been made available. Find out here what changes you can expect.

The new release also includes the necessary adjustments for SEPA DK 3.1 for the current NAV versions from 2013 upwards. For the other versions (from NAV 2009 and older), an update will be provided in the form of a SEPA Service Pack. It will come into effect on November 19, 2017.

With the entry into force of the EU money transfer regulation for customers and suppliers, the adjustments take into account the change that complete address data must be entered in the SEPA files.

We have summarized the most important changes for you.

Payment transactions - Release 20

- The file structure for direct debits and credit transfers complies with the requirements of SEPA DK 3.1

- Integration of the requirements of the EU Money Transfers Regulation ("Money Laundering Act"): Transfer to the file for direct debits originating in non-EU countries by means of address data specified by the direct debit recipient

- Extension of the characters from 24 to 34 of field 86/subfield 31 ("remitter account number") in connection with MT940 files

- Automatic assignment of only a single statement number for files with multiple pages (MT940 files that do not contain a statement number)

- During clearing determination when importing camt.053 files, the field "Transactions additional info" is made available together with the purpose of use

- The "Customer payments" function is now also available for the dynamo modules CH-DTA and MT101.

- Use of the "Print cover sheet only" option when creating disk enclosure slips

- Update of the URL for bank code download

SEPA DK 3.1/ SEPA Service Pack

The latest SEPA version DK 3.1 will come into force on November 19, 2017. The relevant changes will be delivered as part of Release 20 or the SEPA Service Pack.

- Adaptation of the file structures in accordance with the DFÜ agreement for credit transfers (SEPA CT) and direct debits (SEPA DD)

- Implementation of the EU Money Transfers Regulation ("Money Laundering Act") for direct debits and payments from/in non-EEA countries in the SEPA area

In order to use the SEPA DK 3.1 format, the bank account in NAV must be converted. A transfer according to the new specifications is generally possible from November 20, 2017. We recommend that you consult your bank beforehand regarding individual transition periods.

Adjustments to the schemes

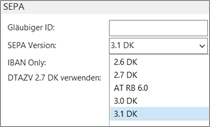

The updated file structure is used automatically as soon as the "SEPA DK 3.1" option is activated in the bank master.

Implementation of the EU Funds Transfer Regulation

With the entry into force of the EU Funds Transfer Regulation, the complete address data for customers and suppliers must be entered in the SEPA files if the business partner is from a non-EEA country (e.g. Switzerland).

A corresponding note can be stored via an extension to the country table, which results in the corresponding details being inserted in the direct debit or credit transfer file. The adjustments have no influence on your business processes.