1 - Set up a cash flow plan (any number of plans can be created)

Determining the periods and other parameters, e.g. including outstanding orders from the purchasing department or taking current cash and cash equivalents into account. It is also possible to refer to expected income and expenditure (see also cash flow forecast).

2 - Preparation of a cash flow forecast

You can carry out a cash flow forecast at regular intervals. Microsoft Dynamics NAV provides you with information on the following sections: Cash Receipts, Cash Disbursements, Net Cash Flow or Cash-in-Hand.

Deposits are details of the revenue received by the company:

Total deposits = receivables + open customer orders + open service orders + asset disposals + manual sales + planned income

Cash payments are details of payments made by the company:

Total cash outflows = liabilities + open orders + fixed asset investments + manual expenses + planned expenses

Net cash flow or cash-in-hand is calculated as total receipts minus total payments at the end of each period:

Net cash flow = total cash inflows - total cash outflows + cash and cash equivalents

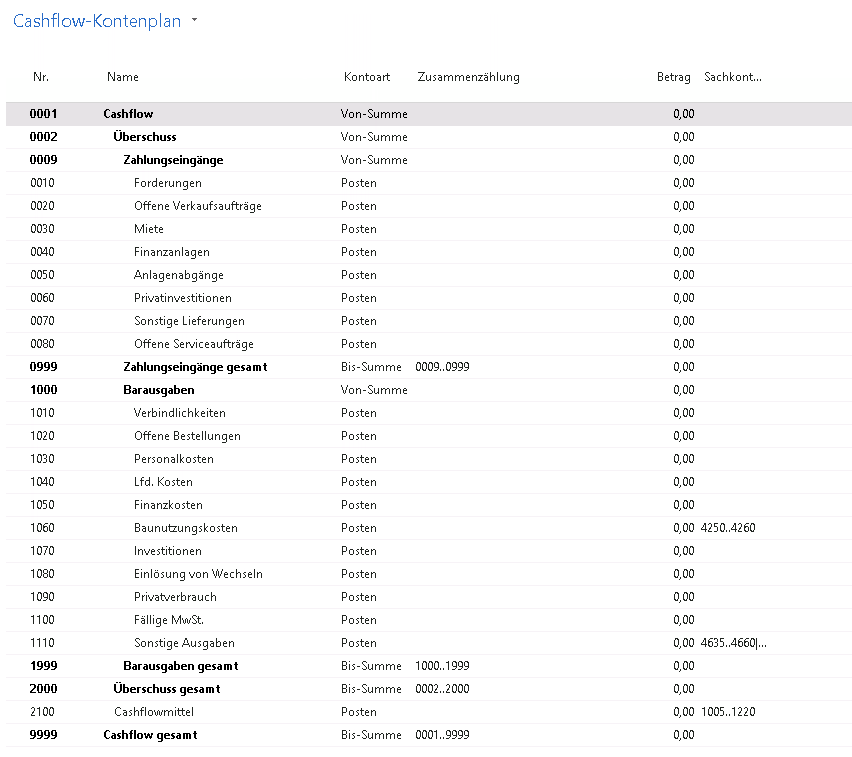

3 - Create your own cash flow chart of accounts based on your normal chart of accounts, in which you can flexibly define which accounts should be included in the planning.

4 - Optional: Definition of one-off or periodically recurring manual cash flow income (e.g. periodic rental income) and cash flow expenses (e.g. salaries, planned investments)

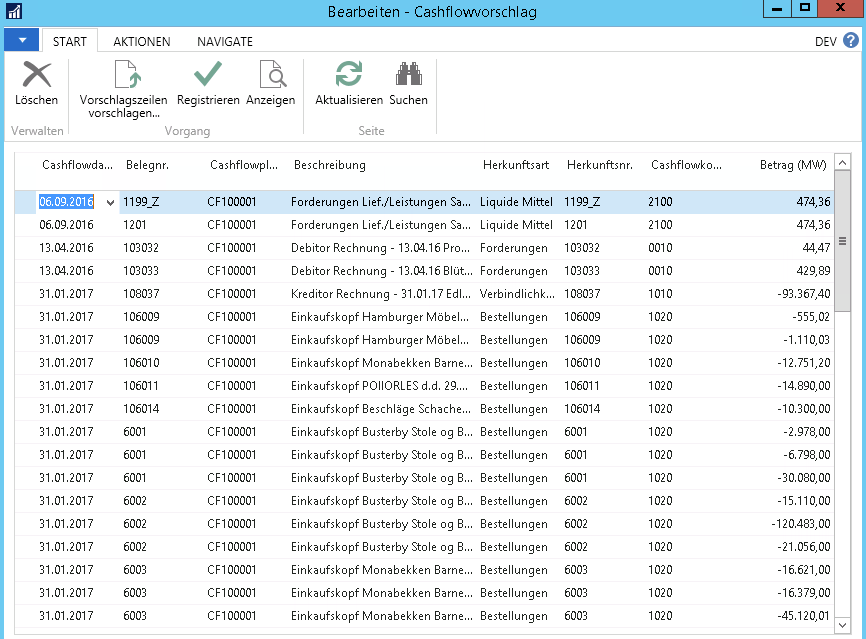

5 - Implementation of the cash flow proposal for a specific cash flow plan

Based on the previous steps, Microsoft Dynamics NAV 2016 automatically determines cash flow planning lines with reference to the specific business transactions (e.g. customer invoices). These default lines can be edited according to your requirements and deleted if necessary. After optional editing, the planning lines can be registered and are available for analysis.

Further functions and options in liquidity planning in Microsoft Dynamics NAV 2016: